Performance - 2024

1st Quarter 2024

The first quarter of 2024 was led by mega-cap stocks that powered the entire market higher. Short term breadth (the percentage of stocks in the S&P 500 above the 50 day moving average) actually declined in the S&P 500 from the start of the year through the first week in February, then started improving before declining again later in March. This means that the number of stocks that have been participating in the stock market rally since 2024 started has mostly been declining except for a short period of time in February. Simply put, this was a more difficult market to trade than during the two healthy periods in 2023 where more stocks made big gains. There were fewer stocks making big gains during the first quarter of 2024 so it was imperative to select the right stocks or it was difficult to really outperform.

One thing that stands out in these big winning stocks is that they all tie multiple characteristics of a high quality Stage 2 breakout in their initial breakout higher. Most of these stocks were in strong sectors, broke out on big volume out of a large basing pattern, and had minimal or no overhead resistance.

Having minimal overhead resistance after a breakout is a key ingredient across the best breakouts. The Chartbook has many past examples of big winning stocks that immediately started making new highs with no overhead resistance right after their breakout. The two most popular examples from 2024 are NVDA and SMCI. Both of these stocks had all of the characteristics of a high quality Stage 2 breakout present on their breakouts which contributed to the phenomenal moves they had after their breakouts.

Many of these stocks were also recent IPOs or were stocks that were new leaders that hadn't led the market before. One characteristic the stock market tends to display over time is that new stocks tend to become big winners for the next cycle instead of older stocks that everyone is familiar with. New stocks to trade tend to attract the attention of the market which is a good thing to keep in mind when deciding what stocks to trade. When choosing between stocks its better to go with a recent IPO. Another thing recent IPOs tend to have is less overhead resistance especially if they IPO after a stock market correction.

The following big winning stocks from 2024 are reviewed in the video below and the issue of this newsletter they appeared in is noted:

Semiconductor and Electronics stocks - NVDA (Issue #59), ARM (Issue #52), SMCI (Issue #55 and #59)

Artificial Intelligence stocks - SOUN (Issue #63), APP (Issue #61)

Healthcare/Biotech stocks - VKTX (Issue #54 and #59), JANX (Issue #65)

Cryptocurrency stocks - MSTR (Issue #48 and #63)

Consumer Cyclical stocks - CVNA (Issue #54, #63 and #65), SG (Issue #64 and #66), CART (Issue #60 and #64), CAVA (Issue #55), CROX (Issue #59)

Financials stocks - ROOT (Issue #65)

2nd Quarter 2024

With the second quarter of 2024 wrapping up this week it's time to review some of the best performing stocks. The goal of using Stage Analysis is identifying some of the best stocks to trade in the stock market across any stock market sector. Its important to review the best performers to see if Stage Analysis is identifying these stocks early enough to profit from their moves.

One observation from this past quarter is there wasn't really a strong sector move besides semiconductors to take advantage of, so most of the big gains were in individual stocks in different sectors. And many of these big winners were Stage 2 investor breakouts out of Stage 1 bases on powerful volume. This isn't surprising as one of the key edges in Stage Analysis is a breakout on powerful volume which surprises the market.

Despite the continued hype in artificial intelligence, NVDA was one of the only stocks in the top 60 in terms of performance in Q2 2024. Price action and volume are always more important than media hype, especially early in a new bull move. Remember the big gains in artificial intelligence stocks were made in May - July 2023 when many AI stocks scored triple digit gains over a short period of time with powerful Stage 2 breakouts. This was still one of the easiest periods to trade in the stock market over the past year.

There was finally a correction to take advantage of this quarter but it didn't produce many big winners coming out of it. IWM was actually down -3% this quarter, and over 300 stocks in the S&P 500 were down on the quarter. Don't get discouraged if you didn't perform well this quarter as it was not an easy market despite a stock market correction occurring in April. There were few stocks that were up big this quarter, there was a lack of strong sector moves, and the majority of stocks actually declined on the quarter.

Remember stock market corrections are what setup big gains. It's easy to lose sight of this fact since there's still only been one correction since the October 2023 lows. There's a good chance another stock market correction will occur during Q3 2024 and that will be where big opportunity lies. Those who are patient and wait for this buying opportunity will be rewarded.

The following stocks are reviewed in the video below:

NVDA, CAVA, ZIM - Issue #74

ENVX, GME - Issue #75

NVAX, AOSL - Issue #76

ASTS, IREN - Issue #77

SMR - Issue #78

NNE, CHWY, CRDO - Issue #79

WULF - Issue #80

(Note: Stocks in bold were on the Best Stage 2 Breakouts list for that issue of the newsletter)

3rd Quarter 2024

The 3rd quarter of 2024 is coming to close so its time to review some of the best performing stocks in the stock market. This quarter was largely influenced by two stock market corrections. The first correction started in July and lasted until early August, and was the largest correction so far for 2024. This correction ended in a panic on Monday, August 5th where a major reversal put a bottom in the market. The second correction was shorter but took the S&P 500 down nearly -5% in early September. The bounces out of each of these corrections is where profits were made in Q3 2024, especially out of the major correction that occurred in early August. Remember stock market corrections are the best opportunities each year to make money on the long side in the stock market.

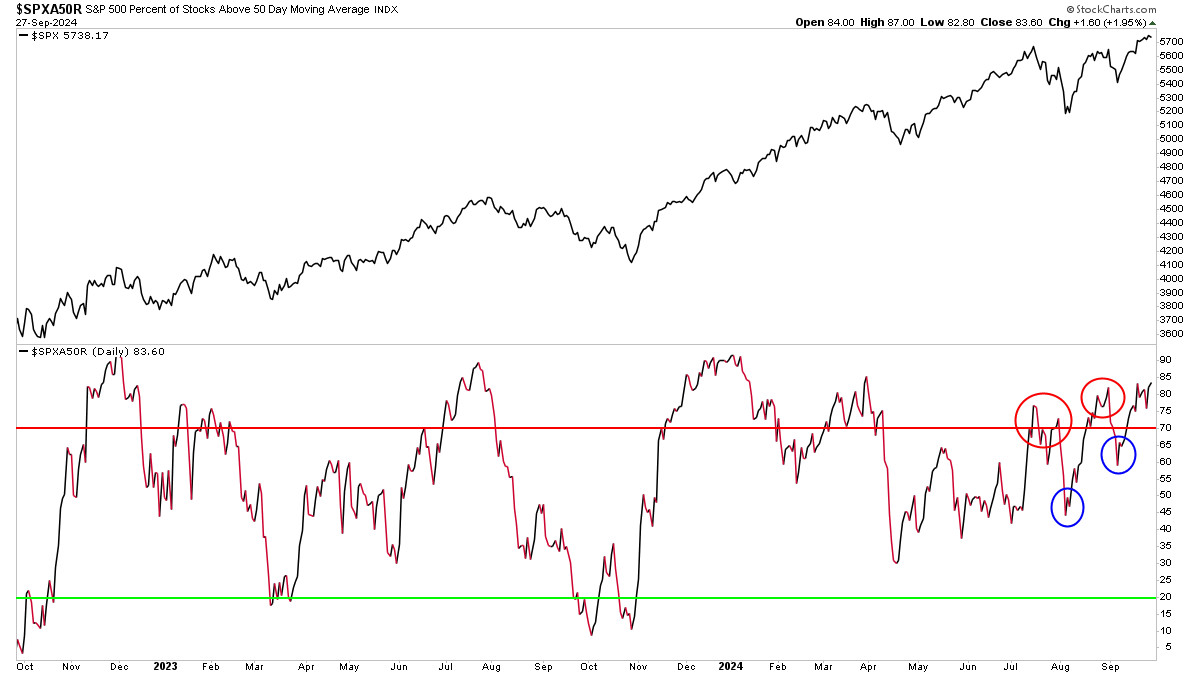

One of the reasons it was harder to make money in Q3 2024, and there were less opportunities on the long side, is breadth remained elevated throughout the quarter except for the two corrections that occurred. The chart below shows the percentage of stocks in the S&P 500 above the 50 day moving average. The red circles indicate when breadth was overbought, and these areas were periods that led to the two corrections in Q3. The blue circles show where the opportunities to get long were and those were after each correction. Notice how breadth didn't get down to the green line during the correction that led to the August 5th panic. The August 5th panic was the best opportunity to buy stocks this quarter but was still no where near as oversold as the market typically gets during major corrections.

The fact that stocks were so out of position to produce big gains to the long side left the short side open and this newsletter had a couple great trades to the short side in Q3. In Issue #86 the inverse ETFS UVXY and SOXS produced big profitable trades playing the downside, with UVXY gaining over 100% heading into the August 5th panic! The process in the Timing Model identified a potential correction looming in the stock market in July and playing the short side was a way to take advantage of this correction.

Issue #89 had a lot of big winners coming out of that August 5th panic and largest correction of 2024. So this again proves that major corrections in the S&P 500 are the best buying opportunities of the year. Remember how panicked the market was on August 5th? Emotions are what drives traders to make the wrong decisions at key turning points, and the panic back then was no exception. Learning to view corrections as massive opportunities is how to take advantage of them, and the Timing Model and Correction Playbook can help.

With the market still out of position with breadth overbought heading into Q4, another massive opportunity is brewing in the stock market. Both Q2 and Q3 were not great trading environments, but the environment AFTER the next major correction is likely to be a great opportunity. So staying patient and letting opportunity come is a great way to head into Q4!

The following stocks are reviewed in the video below:

RDFN - Issue #85

UVXY, SOXS - Issue #86

LUMN - Issue #88

YOU, PLTR, SWIM, APP, RKLB, AHR, CAVA - Issue #89

CRMD, UVXY, SOXS - Issue #90

BILI - Issue #91

PSNY - Issue #92

DADA, JD, BEKE - Issue #95

(Note: Stocks in bold were on the Best Stage 2 Breakouts list for that issue of the newsletter)

4th Quarter 2024

The last quarter of 2024 saw perhaps the most speculative period for the stock market since early 2021, where multiple hot sectors produced monster winning stocks. The birth of the rally was the two corrections that occurred in August and September 2024 in the S&P 500 that set the stage for the 4th quarter rally. There was also volatility before and after the presidential election that became good areas to buy stocks that had huge moves higher. Overall the stock market had a big run from August to December 2024, and it was in the top sectors discussed below where the gains were the greatest. Sector strength is the top edge in Stage Analysis and the best way to find the biggest winning stocks based on the sector they belong to.

Quantum computing was the top sector move in the 4th quarter of 2024 and the biggest winning sector move since early 2021 where the stock market was in a speculative frenzy. This sector move was kicked off by the breakout in IONQ (the sector leader) which occurred towards the end of September on heavy volume. IONQ went on to go up more than 4x after its initial breakout over the next 3 months. After IONQ kicked off the sector move the small cap stocks in the sector like RGTI and QBTS broke out later and had powerful moves higher over a short period of time. The quantum computing sector is tiny, and with the amount of capital moving into it the stocks had nowhere to go but dramatically higher. The volume coming into these stocks is a key observation to the dramatic increase in buying pressure during this period.

The move in quantum computing stocks was driven by the overall resurgence of the artificial intelligence theme which had its biggest quarter of 2024 in the 4th quarter. Other artificial intelligence related stocks that had big moves higher included ALAB, OKLO, SOUN, TSLA, and BBAI. Unlike the 1st quarter of 2024 which was driven by semiconductors and mega cap technology stocks, the 4th quarter of 2024 saw huge moves by small cap stocks that had underperformed for most of the year. It took the stock market about two years since the end of the bear market in October 2022 for speculation to return to the small caps which the market hadn't seen since 2020 for the most part.

Almost all of the big winners below lagged earlier in the year, or had multiple failed breakouts before they finally broke out and had major moves higher. This goes to show that just because a stock fails to breakout doesn't mean that future breakouts won't work in a major way. Often times a stock will fail to breakout multiple times in Stage 1 until the eventual breakout occurs, so it pays to keep an open mind and not dismiss stocks if they have previous failed breakouts.

The following stocks are reviewed in the video below:

ALAB, OKLO - Issue #95

IONQ, KC - Issue #96

SOUN, LUNR - Issue #99

TSLA - Issue #100

PRCH - Issue #101

ACHR, RGTI, QBTS, BTDR, KC - Issue #102

QSI, BBAI - Issue #104

(Note: Stocks in bold were on the Best Stage 2 Breakouts list for that issue of the newsletter)

Disclaimer

The views and opinions expressed on this website are for educational and informational purposes only, and should not be considered as investment advice. The author may hold positions in stocks mentioned on this website. The author of this website is not a licensed stockbroker or financial advisor. Nothing contained herein should be construed as a recommendation to buy, hold or sell any securities or financial products. Always seek the advice of a financial advisor and do your own independent research prior to making any trade or investment decisions.

We do not guarantee the accuracy or completeness of any information on this website. Such information is provided “as is” without warranty or condition of any kind, either express or implied. Past performance may not be indicative of future results. This website could include inaccuracies or typographical errors.

We are not liable or responsible for any damages incurred whatsoever from actions taken from information provided on this website, including financial losses. Since all readers who access any information on this website are doing so voluntarily, and of their own accord, any outcome of such access is understood to be their sole responsibility. In no event shall we be liable to any person for any decision made or action taken in reliance upon the information provided herein.