Issue #9 - Breakouts Proliferate $BOTZ $CARZ $SMH

Trend Of The Major Indices And Market Health

The S&P 500 was up over 2% for the week and is edging closer to a Stage 2 breakout for the overall market. Technology really outperformed this week with the Nasdaq 100 up almost 5% for the week and moving above the 30-week EMA (Exponential Moving Average). As was stated briefly in Issue #5 the potential for a mean reversion in January (which is what often happens to oversold sectors going into the new year) in the technology stocks was definitely there after being crushed in 2022 and that is exactly what has happened this year.

After a dramatic Stage 4 decline to end 2022 TSLA has reversed strongly especially after earnings this week and was up over 30% for the week on the heaviest volume in more than 2 years. TSLA is still in Stage 4 but this dramatic reversal is showing a definite bid in large cap technology stocks again. MSFT also reversed higher after earnings and closed near the highs for the week on above average volume. The large cap tech headwind in the overall market appears to be disappearing, and this is a key component of a longer term uptrend returning to the stock market.

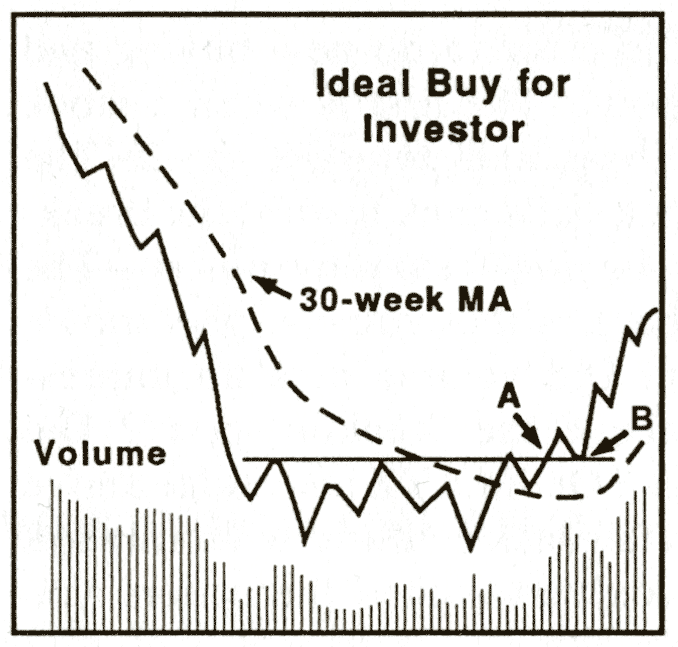

The Dow Jones Industrial Average remains in Stage 2 and the rest of the major indices are in Stage 1 with potential to move into Stage 2 as early as next week. Remember the first item and most important item in the "Forest To The Trees Approach" in Stage Analysis is seeing an uptrend in the overall market to trade the market successfully on the long side. Probabilities of success increase dramatically when the S&P 500 is in Stage 2 and was essentially the big problem for most stocks in 2022.

Breadth continues to improve with the percentage of stocks in the Nasdaq 100 above the 200 day moving average at 63% now and in the S&P 500 nearing 70%. There are many more stocks moving into Stage 1 and 2 than Stage 3 and 4. The overall basing structure for the S&P 500 is now about 8 months long so it has morphed into a solid foundation for a new uptrend if the market continues to move higher here.

Finally the most important aspect to the action in the stock market this week was 1) an expansion in Stage 2 breakouts to include more sectors including some technology stocks and 2) bigger volume in more Stage 2 breakouts. Broadening participation and stronger volume is a key component of a strong uptrend in the stock market and was lacking for all of 2022. It will be important for that trend to continue over the next few weeks to months if the S&P 500 is going to move back into Stage 2.

Sector Review

China (KWEB, FXI) - both KWEB and FXI were up again for the week with multiple China stocks making new highs for their recent moves higher. This sector is not producing many new Stage 2 Investor breakouts anymore as most stocks have now broken out with a few remaining laggards. However this sector could have a very long way to go given the fact that it is coming off of a deep bear market in the short term and a larger 10-year basing pattern in the long term. So patience will continue to be a critical component to riding this new trend.

Gold, Silver, And Mining Stocks (GLD, SLV, GDX, SIL) - gold was slightly down this week along with silver and the miners but more importantly they are starting to underperform the S&P 500. Gold and silver are also both around resistance levels where they were unable to breakout from in early 2022. It's possible the precious metals need to consolidate recent gains here and there still is a lack of volume in this sector and a lack of new Stage 2 breakouts. When volume returns that will be a signal to focus back on the precious metals, until then there's a chance this sector needs to take a pause here.

U.S. Dollar (UUP) - the U.S. dollar was just about flat for the week with the market up strongly for the week. This is one of the first times in multiple weeks the U.S. dollar has held its ground while the market was rallying. With tech stocks finally starting to get a bid its possible we get a bounce in the dollar as nothing goes straight down forever. Foreign currencies are probably due to consolidate recent gains as well, both the Euro (FXE) and the Yen (FXY) have gone straight up off of their lows in October.

Financials (XLF, KRE) - more Stage 2 breakouts occurred in the financial sector this week and that's a good sign for the overall market. Besides tech this was the most active sector last week in terms of new Stage 2 breakouts.

Healthcare/Biotech (XLV, IBB) - healthcare has now declined for 5 weeks in a row and is now underperforming the S&P 500. It is at long term support though and is still above the 30-week EMA. Overall there is still huge potential to be a leading sector in this area but it will be left to the action in individual stocks and whether more high volume Stage 2 breakouts occur. So far its been important to focus on the best breakouts in this sector because a true sector move isn't occurring like China.

Solar (TAN) - the solar sector needs to be avoided for now as it is not acting right as a group. ENPH continues to selloff while other stocks like FLNC and SHLS are having trouble completing breakouts. Contrast this with the China stocks where they produced multiple consecutive weeks of new breakouts on high volume as their sector move flourished. There needs to be more volume in the solar stocks and they need to complete and hold Stage 2 breakouts for this sector to start acting right.

Semiconductors (SMH) - many of the traditional leading semiconductor stocks broke out into Stage 2 this week including NVDA and QCOM. Going back to December we discussed the semiconductors as area in tech that was acting the best but it temporarily started to breakdown before righting the ship recently. The one lacking item in the breakout this week was volume in these stocks but overall a large number of these stocks are now in Stage 1 and Stage 2.

Auto Manufacturers and Technology (CARZ, BATT) - back in Issue #5 we discussed a potential double bottom in this sector and failed breakdown and that has come to fruition. Now this sector is breaking out into Stage 2 and showing relative strength against the S&P 500. The bottom in TSLA helped this sector stabilize and there was a lot of high volume short covering action in other auto stocks last week like LCID and RIVN.

Artificial Intelligence (BOTZ) - artificial intelligence stocks captured the attention of the stock market at the end of the week last week with enormous volume coming into stocks like BZFD and AI. There was a Stage 2 sector breakout here 3 weeks ago and it will be important to see how this continues over the next couple weeks. If this is a real move this is the top area to focus on now for the near term and we should see an expansion in the number of stocks "participating" if this is a true sector move. Again the market will tell us what it thinks about this developing theme whether it is real or just hype.

Innovation (ARKK) - this ETF has proved to be one of the biggest boom and bust vehicles over the past few years with tremendous outperformance in 2020 followed by a catastrophic bear market in 2022 that wiped out almost all the gains. Now it is once again a top performing ETF as mean reversion has brought it back up to the 30-week EMA. This ETF is now setup for Stage 2 breakout and if that occurs will further strengthen the case for the end of the bear market and new leadership in certain areas of technology.

Cybersecurity (BUG, HACK) - cybersecurity was also highlighted in Issue #5 as a potential failed breakdown and that has occurred here so far as well with HACK now setup for Stage 2 breakout and BUG rallying back towards the 30-week EMA.

Stage 2 Breakouts

When the overall market continues to improve more and more stocks should start to move into Stage 2 and contribute to the overall uptrend in the market. This means that more sector moves should start to occur. Trading stocks in the most bullish sectors in the market are the top way to increase your returns in the stock market.

With Stage Analysis we're looking for stocks breaking out into Stage 2 around the same time the overall sector is moving into Stage 2. The best stocks in the sector will typically breakout first, followed by the sector as a whole (typically a sector ETF will follow) and then finally the laggard stocks in the sector will be brought higher by the overall sector move. Sometimes these laggard stocks can actually see big performance later on if the sector gets really hot.

Since this newsletter was launched in December 2022 the China stocks have been one of the only true sector moves we've seen so far in the stock market. But with breadth improving more sector moves are probably right around the corner. When the stock market starts to diversify across Stage 2 sectors its prudent to diversify with it and trade multiple sectors.

There's a few different reasons for this. One is that you never know when a sector move will end and whether it will end before the overall market starts to put in a major top. If you put all your eggs in one basket and that basket starts to underperform then you're stuck underperforming the market. Stage Analysis gives the ability to trade ANY sector with the same methodology so that should be taken advantage of. When a sector starts to underperform or exhaust itself and put in a major top rotating into fresh Stage 2 breakouts is one way to continue to outperform the market.

Another reason to trade multiple Stage 2 sectors is diversification. Some sectors are more risky than others. China stocks and biotech stocks are two examples of sectors that have extra risk. Sometimes a single government action such as with China or even with legislation in the U.S. with sectors like cannabis and solar can have major impacts on how the sector performs. So when the market presents the opportunity to diversify away from those sectors and trade more than one Stage 2 sector it creates less risk in the portfolio.

Finally it is impossible to tell during any given cycle which sector will be the leader and for how long. But we know from Stage Analysis that powerful Stage 2 breakouts are an edge to finding stocks that outperform the market. So diversifying across sectors in these stocks increases the ability to find the best stocks in the market. Sometimes during longer term moves in the market you could be concentrated in one sector earlier on and then in another sector later in the bull market.

When do you diversify across Stage 2 sectors? When there are NEW Stage 2 breakouts in another sector that are occurring with the factors of a high quality Stage 2 breakout. It's important to not get "bored" with a sector and trade out of it for another sector that isn't completing a Stage 2 breakout. This can trap capital in sectors that are going to underperform until they transition into Stage 2. Diversification should occur at the ideal buy point which is the Stage 2 breakout just like any other trade.

It's all about trading what the market is giving you and listening to the market instead of forcing your own opinion on the market. The majority of traders trade what they want to happen instead of trading what the market is telling them they should trade. With Stage Analysis we do the latter by listening to the market and trying to interpret what it is telling us.

Best Stage 2 Breakouts

Instead of providing a "Stage 2 breakout of the week" I'm going to highlight the best Stage 2 breakouts going forward. This will especially be important as the market broadens out to include more leading sectors and themes. The attributes of a "high quality Stage 2 breakout" are what is used to determine the best breakouts.

The following are the best Stage 2 breakouts from the past week:

CRDO, AI, W, PLRX, SUMO, XM, STX, AQUA, TIGO, NOW, PCAR, HXL, BZFD

In particular CRDO and AI are two stocks that could be new leaders as CRDO has exposure to the communications equipment and semiconductor themes with many other stocks in those sectors such as QCOM breaking out recently. AI of course could be a dominant stock in the artificial intelligence theme and has the best ticker to associate with that theme.

W is interesting because of the strong volume and short position against it and could be a key leader in the tech mean reversion higher that is continuing.

Overall in terms of new themes to trade the market appears to be shifting back towards technology with the following themes as potential leaders:

1) artificial intelligence

2) semiconductors/communications equipment

All Stage 2 Breakouts From The Past Week

China stocks - LI*, LU*, NOAH

Healthcare/Biotech stocks - DMTK, GANX, PLRX

Financials stocks - DFS*, COF, SF, EHTH, EWBC, AX, AXP, BSAC, TBBK, WAL

Tech stocks - CRDO*, SHOP, SUMO, NOW*, STX, TOST, SQSP*, SPOT*, XM, PD*, DUOL*, DV, HUBS

Oil and Gas stocks - HPK

Industrials stocks - AQUA, PCAR, CR, HXL, RHI

Communication Services stocks - TIGO, NWS

Uranium stocks - DNN*, NXE*, UEC*

Consumer Cyclical stocks - W, MBLY*, LEVI, ALV

Consumer Defensive stocks - LRN

Real Estate stocks - PK

Artificial Intelligence stocks - AI, BZFD

Basic Materials stocks - AXTA

Semiconductor stocks - NVDA, QCOM

(Note: Stocks with a * were previously on the Watchlist and have now completed a Stage 2 breakout)

(Note: Stocks in bold broke out on 2x average weekly volume or higher for the week)

Watchlist

The Watchlist continues to include a large number of technology stocks setup for Stage 2 breakout. There's also a number of consumer cyclical stocks setup for Stage 2 breakout and that continues to speak to an overall improvement in the general market. As always we are looking for stocks that are related to existing emerging themes, so if technology continues to produce stocks that are related to each other breaking out on volume that increases the odds of a sector move occurring which is the most bullish situation to be in.

China stocks - CD, NIU

Healthcare/Biotech stocks - HIMS, AGIO, EVH, OFIX, ACRS, RLAY, SAGE, PHAT

Tech stocks - FROG, IOT, CFLT, BMBL, CTSH, DOCU, HCP, MNDY, NEWR, NET, QS, SNOW, YOU

Uranium stocks - UUUU, UROY

Financials stocks - C, PACW

Consumer Cyclical stocks - PTLO, VSCO, BROS, ZVIA, GM, CHWY, TSCO

Utilities stocks - ARIS

Semiconductor stocks - AMBA, LRCX

Oil and Gas stocks - NEX

Sector Overview - Artificial Intelligence

Every year in the stock market one or more "themes" drive the returns of the best stocks in the market. So its important to pay careful attention to when they emerge and what stocks are involved in the theme. Sometimes the theme is so fresh that it might not be readily apparent which stocks are actually the most tied to the theme and the market itself tries to figure that out. Two recent examples would be the cannabis stocks in 2018 and blockchain and cryptocurrency related stocks in both 2017 and in 2021. Stocks that were related to those themes in those years increased dramatically just because they were associated to the emerging theme. The "theme" is really just a group/sector of stocks that are associated together that benefit from capital flowing into them to participate in the theme.

It's possible this new theme is pure hype and fizzles out quickly or it could be something that captures the market's attention and drives stocks related to the theme higher. It's impossible to know this ahead of time even though many will speculate in either direction. As Jesse Livermore was fond of saying it doesn't matter "why" stocks move higher or lower but simply "what" they are doing.

The exciting aspect of this new potential emerging theme is the fact that many of these stocks are just completing Stage 2 Investor breakouts as this is just starting to develop. So if it does become a trend this is an ideal buy area to begin participation and the volume so far is indicating explosive interest in the sector.

Since there are a plethora of software stocks out there more stocks can potentially join this theme and it will be important to let the market decide who the true players are.

The following are the artificial intelligence related stocks discussed in the video:

BOTZ, BZFD, MARK, AI, NVDA, MBLY, HUBS, PLTR, SPLK

Disclaimer

The views and opinions expressed on this website are for educational and informational purposes only, and should not be considered as investment advice. The author may hold positions in stocks mentioned on this website. The author of this website is not a licensed stockbroker or financial advisor. Nothing contained herein should be construed as a recommendation to buy, hold or sell any securities or financial products. Always seek the advice of a financial advisor and do your own independent research prior to making any trade or investment decisions.

We do not guarantee the accuracy or completeness of any information on this website. Such information is provided “as is” without warranty or condition of any kind, either express or implied. Past performance may not be indicative of future results. This website could include inaccuracies or typographical errors.

We are not liable or responsible for any damages incurred whatsoever from actions taken from information provided on this website, including financial losses. Since all readers who access any information on this website are doing so voluntarily, and of their own accord, any outcome of such access is understood to be their sole responsibility. In no event shall we be liable to any person for any decision made or action taken in reliance upon the information provided herein.