About this site

Next Big Trade Premium is an independent publication launched in December 2022 by Justin Smyth. If you subscribe today, you'll get full access to the website as well as email newsletters about new content when it's available. Your subscription makes this site possible, and allows Next Big Trade Premium to continue to exist. Thank you!

Access all areas

By signing up, you'll get access to the full archive of everything that's been published before and everything that's still to come. Your very own private library.

Fresh content, delivered

Stay up to date with new content sent straight to your inbox! No more worrying about whether you missed something because of a pesky algorithm or news feed.

Welcome!

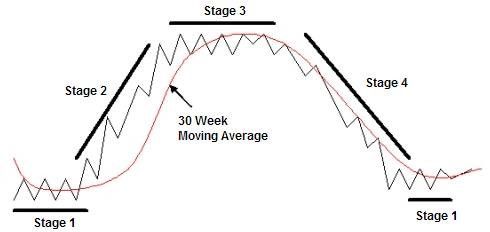

Welcome to Next Big Trade Premium where I aim to deliver quality stock market research and education using Stan Weinstein's Stage Analysis to members of this service. I firmly believe Stage Analysis is the best stock market trading system ever invented and my goal is to 1) show how I apply the system to the current market and 2) pass on what I've learned over the years using the system.

How I Breakdown The Market

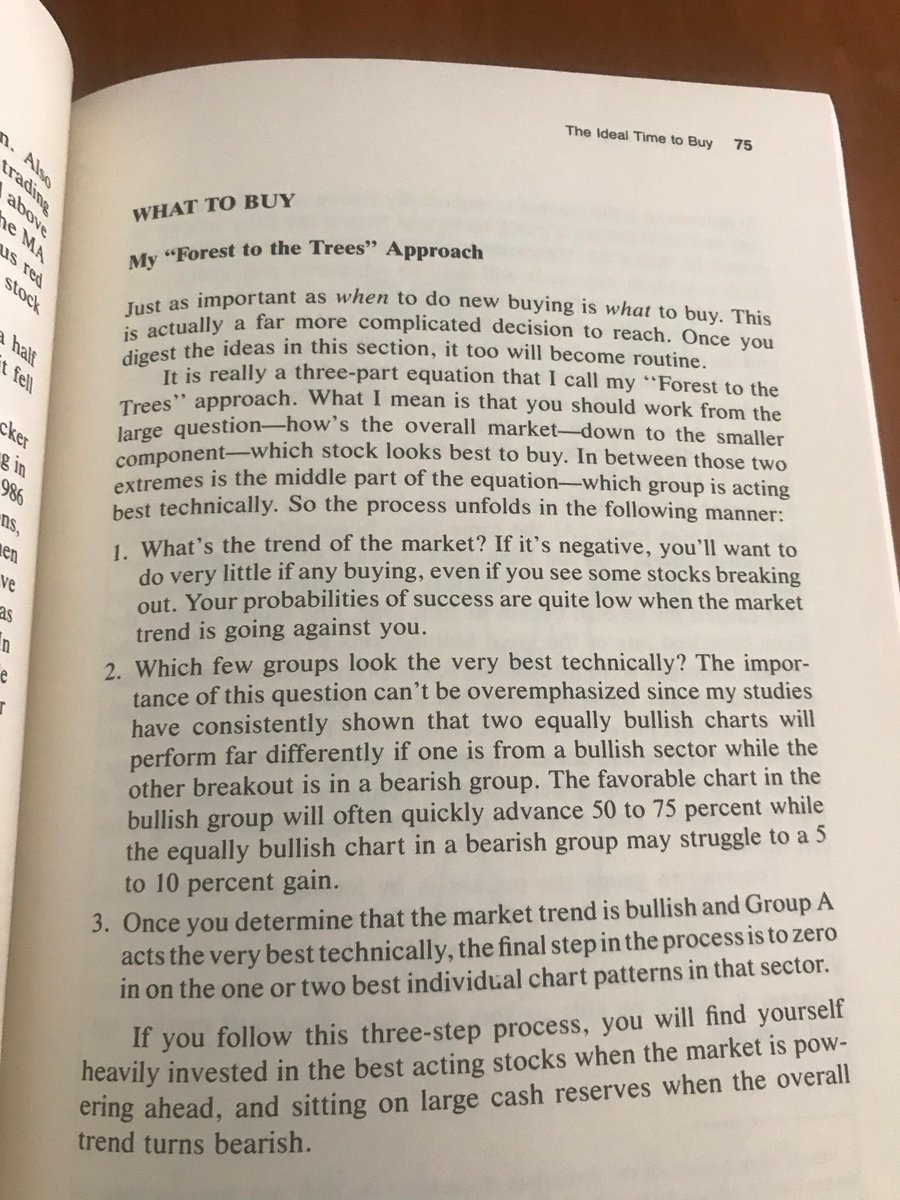

My favorite way of breaking down the stock market is using the "Forest To The Trees Approach" in Stan Weinstein's book Secrets For Profiting In Bull And Bear Markets. This process involves determining the following:

- What is the trend of the overall market?

- What sectors are leading (or lagging) the market?

- What stocks look the best (or worst) technically in that sector?

If the trend of the overall market is bullish then you want to look for sectors that are completing Stage 2 breakouts and the best stocks in those sectors. Conversely if the trend of the overall market is bearish it's better to either largely be in cash or looking for shorting opportunities with stocks completing Stage 4 breakdowns. Bear markets overall are much trickier to trade than bull markets so heavier cash positions and a more tactical approach is the best way to navigate them.

Newsletter Format

The newsletter will mimic the Forest To The Trees Approach by discussing the trend of the overall market, leading and lagging sectors in the market, and stocks that are completing or setup for Stage 2 breakout or breakdown. The types of sections in the newsletter are described below:

Trend Of The Major Indices And Market Health

This section will go over the trend of the major market indices and some important market indicators to determine what is the major trend of the market.

Long Term Review

Periodically it will be useful to take a step back and look at the current trends in the market and where things might be going. This would include taking a look at multi-year moves in different asset classes to determine what the current trends are and what could be changing in the markets.

Sector Review

This section will go over the sectors that are leading the market when the overall trend is bullish and sectors lagging the market when the overall trend is bearish. It will be important to narrow down the leaders and laggards since stock market outperformance is typically derived from trading the best or worst sectors during any given stock market cycle.

Sector Deep Dive

Periodically it will be useful to take a deeper dive into stocks in a particular sector because the sector is providing explosive Stage 2 breakouts and numerous trading opportunities. Typically the best stocks in a sector will breakout first, but if the sector trend is strong enough more stocks in the sector will continue to breakout. So it is important to carefully study sectors where this is occurring to maximize trading opportunities.

Sector Trades

Sector ETFs can dramatically outperform the S&P 500, and typically perform better than at least half of the stocks in a sector. And since they are less volatile they could potentially be held during a correction with a smaller position size to attempt to hold a long running trade through more than one cycle. So they are a great option for participating in a sector move with less individual stock risk. Sector Trades will periodically call out stock market sector trades using ETFs, ideally around the Stage 2 breakout area of the sector.

Long Term Trades

Using Stage Analysis to find sector leaders that have the potential to trend higher for multiple cycles and across stock market corrections. Compounding gains across stock market corrections is how a long term position can dramatically outperform.

Reviewing Previous Breakouts And Watchlist Stocks

This section will review stocks highlighted as Stage 2 breakouts or on the Watchlist in past issues. The goal here is to show whether things are "working" as in breakouts are following through or "not working" as in a stock breaks out and then fails and moves back lower. When stocks start working and especially in a group/sector move typically more stocks will follow along.

Leading Stocks

This section will periodically discuss the stocks that are leading the market. Leading stocks by my definition are stocks that display the following characteristics:

1) They trade with no resistance (or very minimal resistance) and are making new highs in an uptrend.

2) They start outperforming the rest of the stock market much earlier than other stocks. They "lead" the market higher. In a bear market this can go on for months before the rest of the market goes back into an uptrend.

3) They are often part of a "theme" or "group/sector". As we know from Stage Analysis getting the sector right is key to finding the best stocks and outperforming the stock market. So these stocks offer "clues" as to where the future leadership in the stock market might reside.

Quarterly Performance Review

This section will review the best performing stocks in the market on a quarterly basis and where their Stage 2 breakouts occurred. The goals here will be the following:

1) Situational awareness - understand what is leading the market in terms of themes and group strength. Often other emerging related themes can be traded from understanding what is currently leading the market.

2) Process review - it's impossible to trade every Stage 2 breakout, but Stage Analysis is a process that helps identify the best breakouts which lead to the best stocks. So by reviewing the best stocks it helps to reinforce whether the Stage Analysis process is being followed correctly.

Stage 2 Breakouts

The Stage 2 breakout is the ideal buy point in Stage Analysis and this newsletter will feature stocks completing Stage 2 breakouts. The Stage 2 breakout will be evaluated according to the attributes of a high quality Stage 2 breakout. Each week the best Stage 2 breakouts will be featured.

Stage 2 Breakout Pullbacks

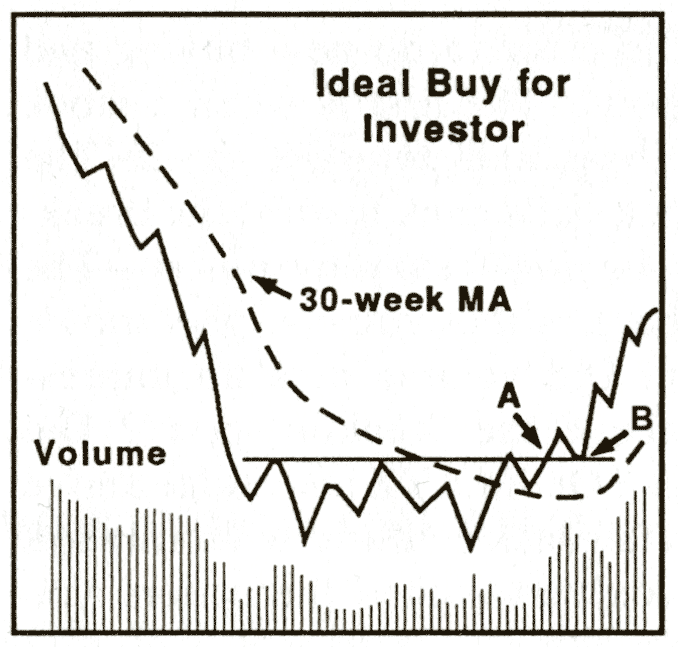

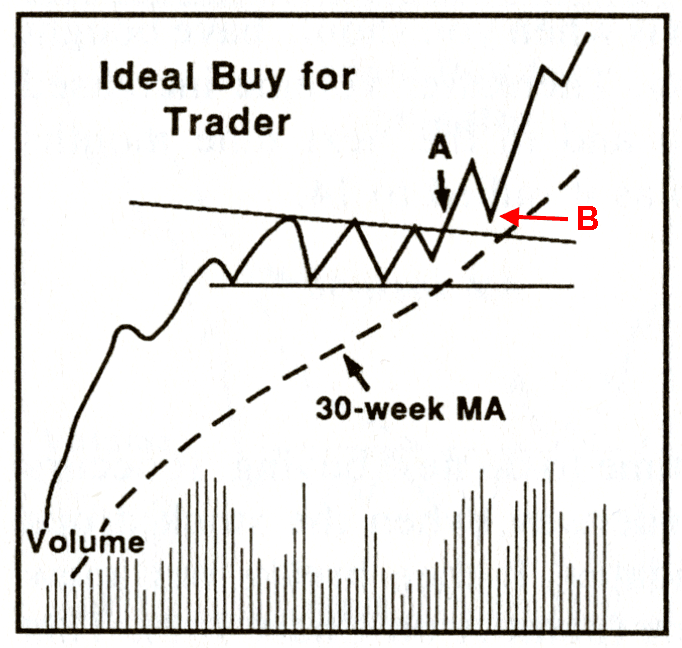

The first pullback buy point is a great area to buy a new Stage 2 breakout. The reason is twofold: 1) the probability of the stock entering a new uptrend is higher, and the entry point is early in the new uptrend and 2) risk/reward is even better than Point A, because the stock has pulled back towards the breakout area. This is highlighted below as Point B on the chart on both the Stage 2 Investor Breakout and the Stage 2 Continuation Breakout. Point B is a good area to either take a small loss if the trade doesn't work out, or get positioned early in a winning trade if the trade continues to the upside.

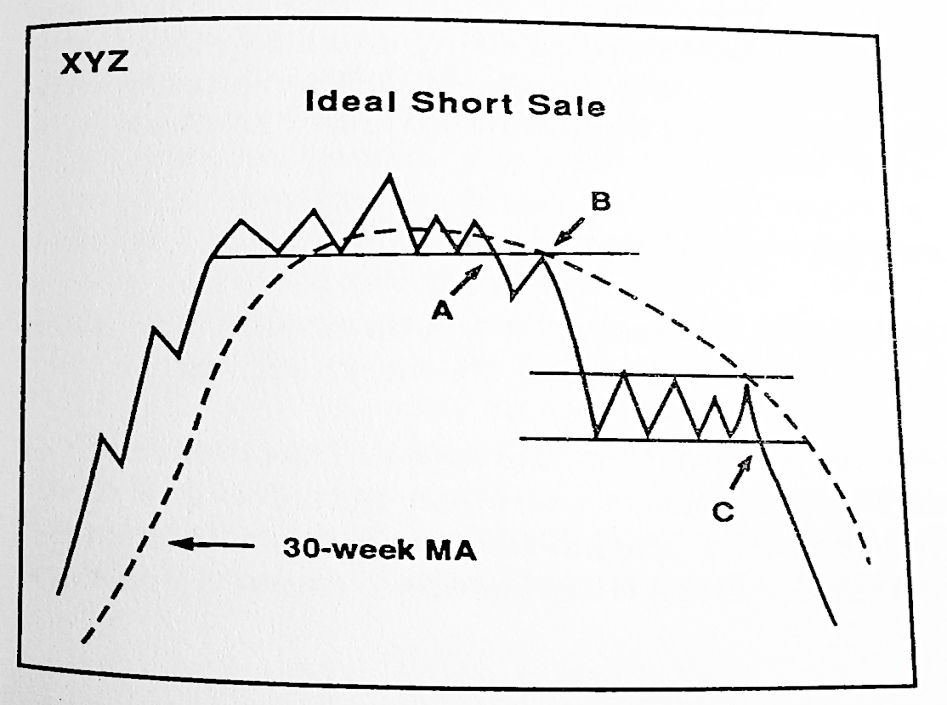

Short Setups

After a stock market rally ends extended stocks and sectors to the upside are in good position to short as corrections will bring them back down to long term moving averages. At the same time weak sectors that didn't benefit from the rally are also good short candidates. Short setups features setups in both areas during stock market corrections.

Stage 4 Breakdowns

When the trend of the market is bearish Stage 4 breakdowns will be featured as they will have higher odds of working in a bearish environment. When the overall trend is bullish they will likely be omitted since profit potential is much greater trading the long side of the market in Stage 2 uptrends.

Focused Watchlist

Building a watchlist of stocks during a correction is a good way to be prepared to trade the best stocks when the correction is over. There's a number of characteristics that strong stocks and sectors will display during a correction, and stocks that demonstrate those characteristics will be explored here.

Sample Newsletters

Questions?

Any questions can be directed to me either on Twitter: @nextbigtrade or E-mail: justin@nextbigtrade.com